1

/

of

1

ROLLINGSPIN

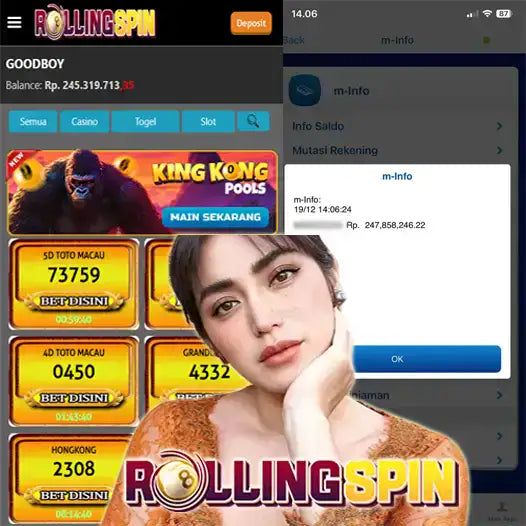

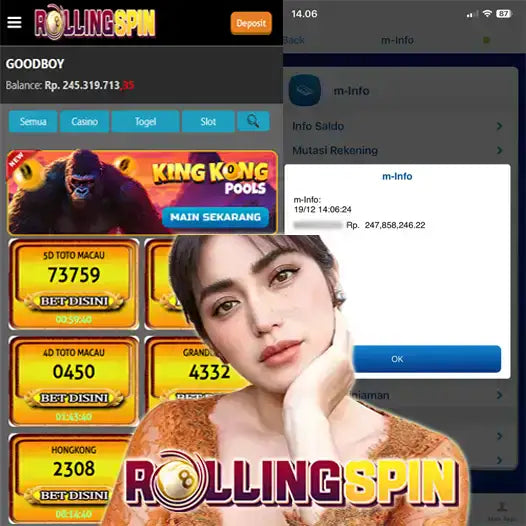

ROLLINGSPIN: Situs IDN Toto Slot Gacor Deposit Pulsa Tanpa Potongan

ROLLINGSPIN: Situs IDN Toto Slot Gacor Deposit Pulsa Tanpa Potongan

Regular price

Rp 88.888,00 IDR

Regular price

Rp 888.888,00 IDR

Sale price

Rp 88.888,00 IDR

Unit price

/

per

Couldn't load pickup availability

ROLLINGSPIN adalah situs judi online idn toto yang menyediakan game slot gacor deposit pulsa tanpa potongan hari ini minimal deposit dana 10rb, daftar dan dapatkan prediksi link slot gacor hari ini pragmatic play bocoran rtp live tertinggi. Tersedia situs judi togel online terpercaya dengan pasaran togel terlengkap bet 100 perak hadiah terbesar di indonesia.

SLOT GACOR

https://rollingspin.tumblr.com/

https://betrollingspin.com/

https://hspau.com/

https://www.hivino.travel/

https://linkr.bio/rollingspin

https://alittlegreener.com/

https://157.230.41.114/

https://treeremovalcalgary.net/

rollingspin

https://thai.web.universitasbumigora.ac.id/

https://rollingspin.binanusantara.ac.id/